Functional Specifications

Business requirements for iFIX

Overview

Abbreviations & Common Terms

Scope

Fiscal Events-Based Approach

Definition of Fiscal Event

Types of Fiscal Events

Fiscal Event - Sub-Types

Application of Fiscal Event Framework to As-Is-Processes

Overview of Budget Cycle

Inferring Fiscal Events from As-is-Process Flows

Budget Planning

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Actors (2)

Input (3)

Verb & Noun (4)

Output (5)

Attributes (6)

Does it trigger a fiscal event (7)

Fiscal Event Type (8)

Fiscal Event Sub Type (9)

Data Attributes for iFIX (10)

Budget Preparation

Budget Preparation for Revenue Receipt

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event?

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Budget Preparation for Capital Expenditure - Capital Outlay

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Budget Approval

Budget Approval from Legislature (Same process for Revenue and Capital nature Receipts and Expenditures)

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Budget Allocation

Communication and Distribution of funds (Same process for Revenue and Capital nature Expenditure)

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Budget Execution

Request for Release of Funds from State Treasury - Scheme-related Capital Expenditure

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Request for Release of Funds from State Treasury - Revenue Expenditure

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Collection of Revenue Receipt into the State Treasury

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Request for Supplementary Grants (Same process for Revenue and Capital Expenditure)

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Surrender of Excess / Savings (Same process for Revenue and Capital expenditure)

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Budget Accounting

Process for monthly budget accounting/reporting for Receipts (Same Process for Revenue and Capital Receipts)

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Process for monthly budget accounting/reporting -Expenditure (Same Process for Revenue and Capital Expenditure)

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Budget Auditing

Process for budget auditing (have to explore if there are variations for revenue and expenditure)

Actors

Input

Verb & Noun

Output

Attributes

Does it trigger a fiscal event

Fiscal event type

Fiscal event sub-type

Data attributes for iFIX

Definition of Format of Fiscal Event Sub-Types

Annexures

Annexure I

Definitions

Revenue Receipts:

Revenue Expenditure:

Capital Receipts:

The capital receipts are loans raised by the Government from the public (these are termed as market loans), borrowings by the Government through the sale of Treasury Bills, the loans received from Central Government and bodies, disinvestment receipts and recoveries of any loans and advances given.

Capital Expenditure:

Type of Scheme – Central Sector, Centrally Sponsored, State Plan Scheme

Central Sector

Centrally Sponsored Scheme

State Plan Scheme

Type of Loan/ Debt – State Internal Debt or through GoI

Government Debt

Internal Debt

Loans and Advances from GoI

Chart of Accounts

Coding pattern for the units of accounts

Receipts coding pattern

Expenditure coding pattern

Criticism of current COA: Issues in Old COA structure as per Sundaramurti Committee:

Proposed New Chart of Account

Existing COA

What information can be derived solely from COA

What more needs to be done

Single Nodal Account (SNA)

Overview

Benefits of SNA

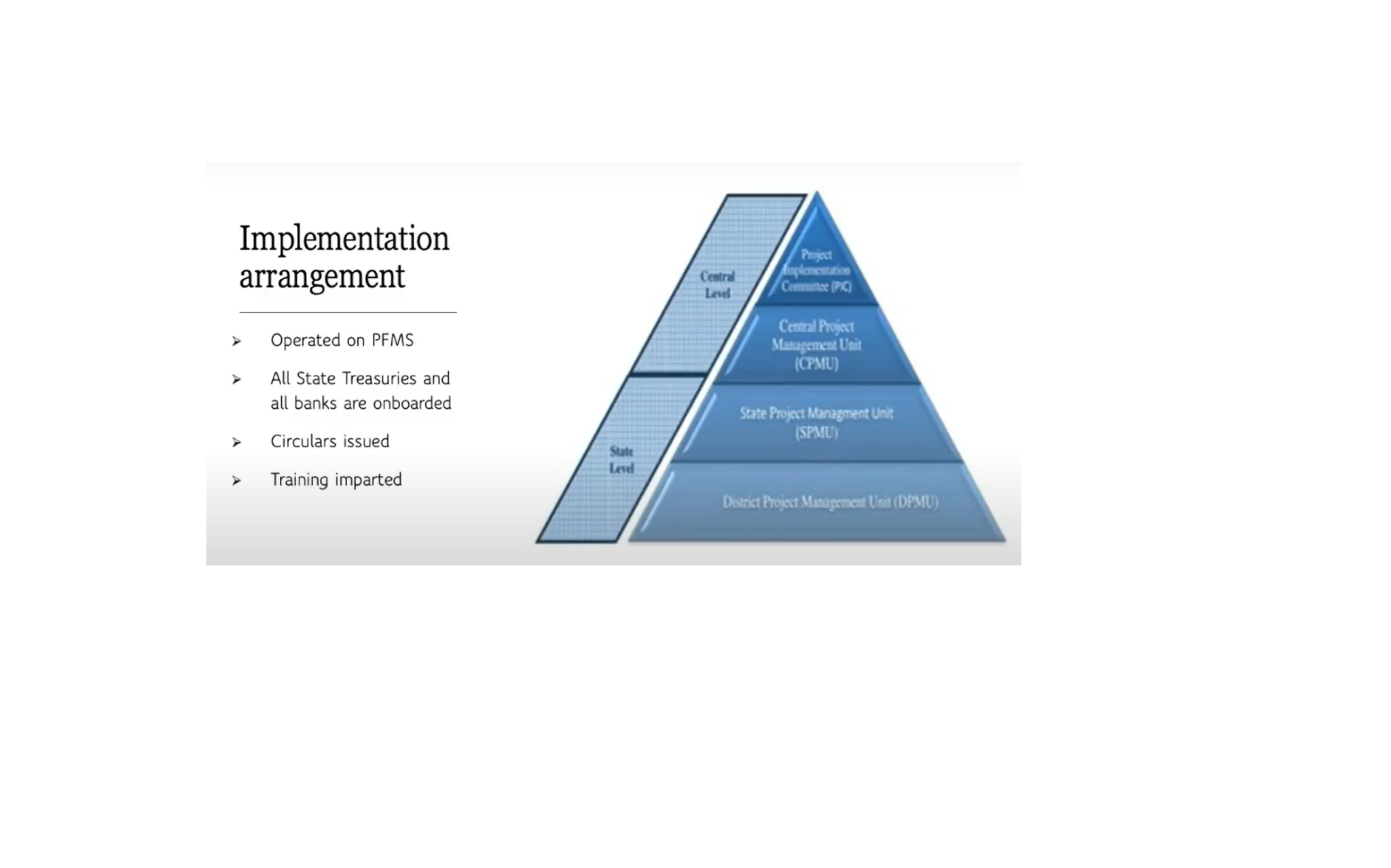

Implementation arrangement of SNA

Key implementation issues wrt SNA

Annexure II- Potential Impact of iFIX on Budgetary Processes (Work in Progress)

State Finance Department Lens

Budget Planning

Budget Preparation

Budget Allocation

Budget Execution

State Line Department Lens

Budget Planning

Budget Preparation

Budget Allocation

Budget Execution

Annexure III - Exploring Use Cases for Gender Budgeting using iFIX

Gender Budget - A Brief Overview

Gender Budgeting in India - How are Gender Budget Statements structured?

Gender Budget Statement - What are the challenges/gaps in GBS preparation?

iFIX and Gender Budget - How can iFIX enable and support gender budgeting

iFIX and Gender Budget - Using the Fiscal Events-Based Approach

Fiscal Events-Based Approach of iFIX - Illustrations for Part A and Part B of the GBS

Annexure IV- Exploring Use Cases for Health using iFIX

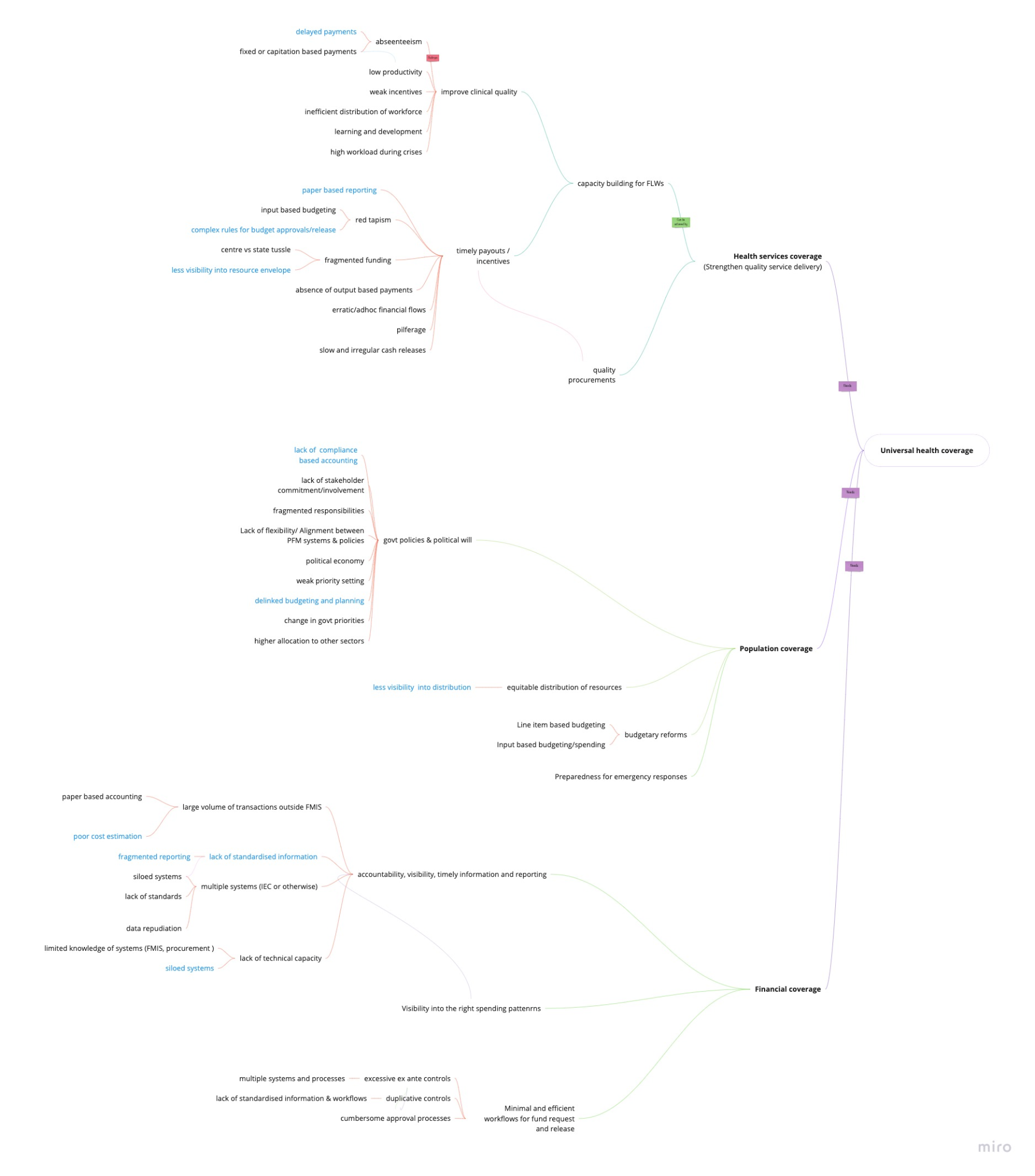

PFM in health - a brief overview

Understanding the problem space*

Centre sponsored NHM

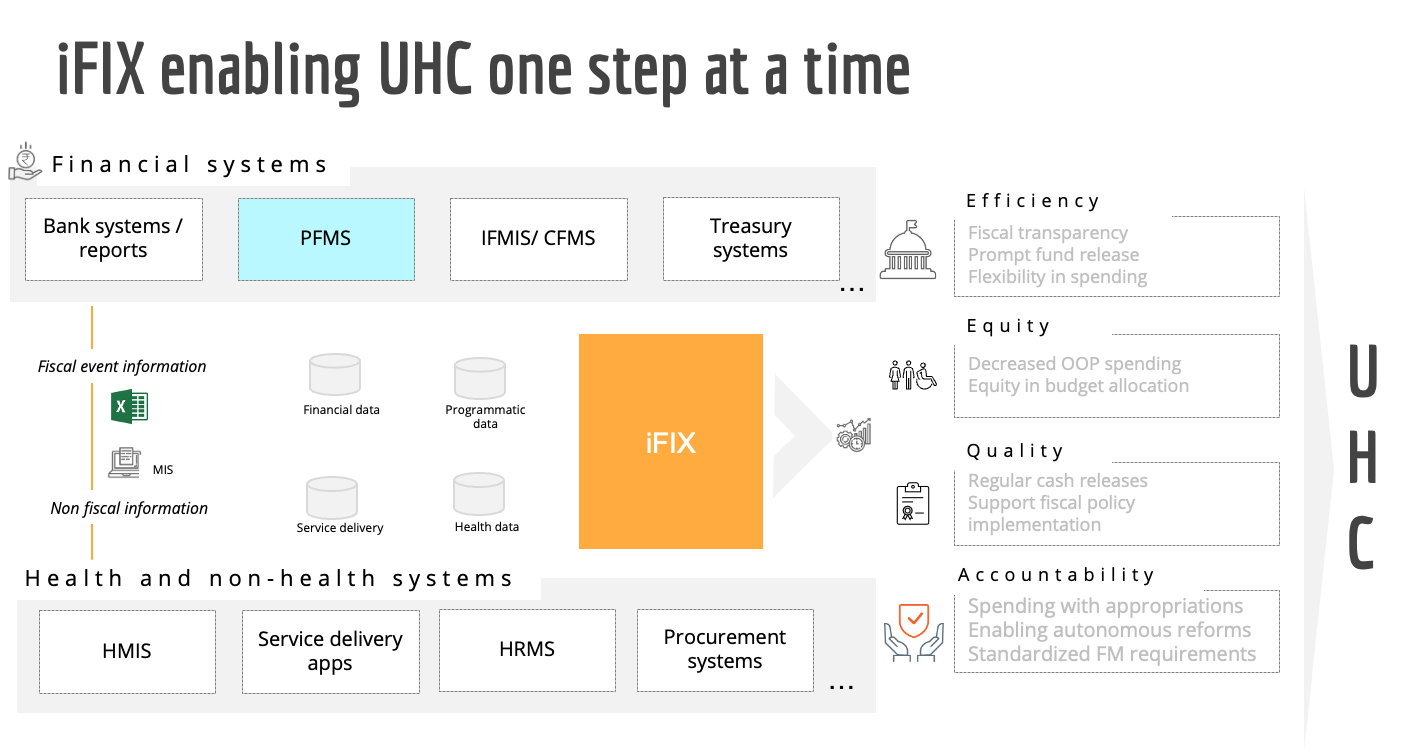

iFIX and PFM in health - How can iFIX enable and support budgeting objectives

Opportunities

Last updated

Was this helpful?